Whilst banks have accepted that technology is the driving force transforming the industry, I still don’t see the transformation being taken as seriously as it should. Instead, banks continue to rely on their traditional sources for success – namely;

- The patronage of their existing customer base

- The exclusivity of their customers’ data (which most recognise and utilise as an asset that opens new opportunities and value)

- Access to large capital pools

- Brand, history, knowledge and the automatic customer trust it brings

- Complicity of Financial Regulation

These sources may be viewed as barriers to entry for new competitors but to me they are contained barriers centred on known threats banks already foresee. What I mean is – yes – banks may be right in thinking new entrants will not be able to provide all the services they provide but it’s the other threats that are not on their radar that they should be worrying about. Threats such as new entrants breaking up their existing value chain, by competing for individual ‘links’ within the chain; or the threat of regulators fueling the open banking movement, creating a legitimate threat to existing customer relationships and historical loyalty. Banks should brace for impact – the Big Techs are coming and the threat is real!

Incumbent Banks

Incumbent business models have for too long relied on their strong customer base and associated income to make them profitable. These incumbents have relationships with regulators, central banks, bureaus and watchdogs spanning many decades and together have evolved and somewhat driven the demands placed on the industry we see today. Their exclusivity in holding and exploiting customer data places them in a strong position to understand what customers want, when and how. The challenge incumbent banks find themselves in is that these same customers are now accustomed to tech driven enriched experiences provided by Big Technology (Big Techs) organisations such as Amazon, Apple and Google and their ability to keep up due to legacy infrastructure, processes (and internal politicking). The competition is obviously broader than that and will continue to come from everywhere impacting parts or all their traditional value chain.

Meet the Competition

Financial Technology (Fintech) start-ups

The last decade has been all about the growing hype around Fintech startups and how they will transform the banking industry and open up the competitive landscape. Helped by the Global Financial Crisis of 2008, and fuelled by the resulting distrust of the big banks, Europe led the way with a wave of new challenger banks being introduced over recent years such as Starling, Monzo, Atom, Tandem, Revolut, N26 etc. Using technology to challenge the traditional incumbent business models, challenger banks were able to charge lower fees, provide instant fulfilment and faster more enriched services to accompany these new customer experiences. Whilst the Fintech hype has somewhat subsided recently as the threat has failed to materialise in proportion to the expectation, Fintechs still hold the promised potential of bringing an Amazon and Netflix style experience to banking and with it increasing the benchmark with respect to customer experiences.

Non-banking Multi-National Corporations (MNCs)

Before the now much talked about Fintech disruption to the Financial Industry was the talk of the industry, Multi National Corporations extending their tentacles and disrupting the same landscape was the primary disruptor candidate. This period saw existing MNC’s already established in their non-banking, industry leveraging their existing infrastructure and customer base by offering additional services to ease the customer experience. I am referring to the emergence of the threat from the likes of Walmart in the US or Tesco in the UK that were highly talked about at the turn of the decade. Whilst the talk may have subsided on these organisations I see them still as very much in play as potential continued disruptors and in-fact the inspiration for what followed with the FAANG organisations – Facebook, Amazon, Apple, Netflix and Google.

Big Technology Giants (BigTechs)

Renowned for transforming the customer experience and driving the digital revolution, the FAANG organisations in the West as well as Ratuken and Alibaba in the East have revolutionised the way we live our day-to-day lives. Their philosophy of using a technology first approach has enabled them to access new markets and eliminate industry driven boundaries. They are technology powerhouses that have been able to disrupt multiple industry landscapes by convert their potential to be many things and leaders in many industries and markets into a reality.

The Bank Landscape on a Chart

An article written by David M Brear published on the blog of the Digital Evangelist, Chris Skinner, uses a simple diagram to depict the “Banking Battlefield”. Using two dimensional chart: Y-axis captures the Number of Customers and the X-axis Intelligent Digital Services, this article plots the position of those vying in this market.

· The number of customers is used because it indicates the revenue potential to the bank.

· Intelligent digital services is used to reflect the digital maturity based on the digital services offered by the organisation – essentially reflecting the ability of the organisation to respond to customer demand changes.

See the two-dimensional diagram below via David M Brear (23rd May 2018) – https://11fs.com/blog/banking-battlefield/

According to David everyone is trying to get the top right quadrant of the diagram – where the BigTech (Non FS Digital Players) already are.

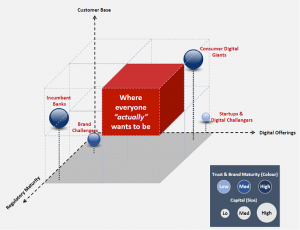

However, whilst this diagram provides a good start, I would like to incorporate a few of the other traditional success sources relied on by banks in assessing the ‘banking battlefield’. Specifically, trust and brand maturity, availability of capital and regulatory maturity are extremely important considerations not factored into this diagram. Incumbent banks have been around for decades.

My attempt to reflect these additional dimensions are reflected in the below 3-dimensional diagram where the Z-axis encapsulate regulatory maturity, whilst representing capital availability by the size of the bubble and colour shades to represent trust and brand maturity of each player. The target to get to the top right quadrant does not change – however the players also want to be at the front of the cube considering the factored element of regulatory maturity. Using these criteria means there is no one currently in the front red-highlighted cube.

The power of the customer in determining the Financial landscape players

For me – if I had to call out one positive from the Global Financial Crisis – it was that it truly highlighted the importance of putting the customer as the most important part of the financial markets value chain. Unveiling the malpractices and corruption, the closed competition, the complexity of junk packaged as derivative instruments resulted in new regulatory practices that opened competition, and provided greater transparency of processes and fees in favour of the customer. The EU has been driving the regulatory reform agenda to make it easier to obtain licenses required to operate in the financial industry. The has enabled the disruptor threat posed by the other participants to materialise. In-turn, the presence of disruptors will mean we continue to reform and lower barriers to entry which had seen arrogant incumbents unnerved as the threat of new competition puts pressure on their stranglehold on customer and hence profitability. Regulation will serve as a set of speed bumps to be slowly navigated through by the challenging parties with the bumps becoming smoother and promoting a more inviting and welcome approach to new competitors without placing the customer at risk.

So, what now?

Firstly, all the mentioned players are bonafide legitimate threats to incumbent banks and the way customers consume financial services. Whilst some of these entrants try to compete with incumbents directly by opening banks to seduce our patronage with more competitive products and/or technology that provides a more enriched digital experiences they are still largely aligned to the existing business models. I would be disappointed if BigTechs did the same. The BigTechs are my beacon of hope for driving the evolutionary maturity of the financial landscape, challenging the status quo and redefining the norm of banking. I see them competing differently, reimagining the entire banking experience and the way which we consume financial services. They already have a global consumer base spanning 10s and 100s of millions. They have sophisticated technology driven distribution with experience in challenging social norms and business models. Most of them have enough liquid capital to make even the biggest banks envious. Hence, they should not be, (and I don’t think they are), aspiring to replicate banks as we know and use today!

I see the existing DNA of banks broken up. I see existing business models replaced. Banks will no longer be the only or first port of call for financial products or services. This is already happening. Japanese company Ratuken and China’s Alibaba already provide a number of financial services such as credit cards, mortgages, asset management, lending and payments. Small and mediums size businesses are able to borrow from Amazon. And Facebook using its messaging app, allows its users to make peer-to-peer (P2P) payments having integrated with PayPal.

Today’s value chain contained within individual industry is being broken up and new value chains are being formed bringing finance closer to where it is demanded. But this is only the start.

Let’s take the complex and time consuming process of buying a house as one example ripe for disruption end-to-end. Today, in most markets, and I will base this on my experience in the UK, you need a mortgage approved in principle before you are taken seriously by a real estate agent. Once you place an offer, a number of checks and conveyancing need to take place before the bank confirms the mortgage and you can complete the purchase (overly simplified for this blog). Even if you are not in a chain (where the seller is waiting for the completion of his next purchase), this process can take months. What a pain! Imagine viewing a property online utilizing Virtual Reality, placing an offer, having a mortgage approved on the spot allowing you to kick-off a set of API driven checks connected to local authorities for their respective compliance allowing you to complete the entire purchase in the comfort of your own home and in a short span of time. That would be some experience! And for any doubters out there questioning the feasibility or attraction of such an experience I remind you of those who questioned the demise of retail brick and mortar stores due to the customer’s need for the touch and feel experience. What we saw instead was a series of business model changes where incumbent department stores were disrupted by the likes of ASOS, who introduced free returns and exchanges to provide the consumer confidence in the process and claim customer loyalty. Still doubt the possibilities?

Credit is another simple example of how we access Financial services when instantly – something we can do when purchasing from one of the BigTechs such as Apple or Amazon. The process is refined so smoothly and the experience enriched to the point finance is provided almost in stealth – without the customer even knowing they have taken a loan (yes there is a regulatory element and responsible lending which needs to be considered), but incumbent banks cannot assume they will be the sole providers of financial services and that customers can afford the time to call upon the banks with their incumbent processes and value chains. BigTechs are looking at all the value chains that impact the customer to see how it can be disrupted and how they can get more entrenched and be integral in the consumer lifestyle.

This process of Disintermediation, which sees customers turning to other more unlikely sources to address their financial needs, which in turn leads to Product Unbundling as customers exercise their right to pick and choose from a myriad of service providers. As we see PSD2 and Open banking initiatives open up which channels we as customers use to access our accounts and perform transactions banks should fear losing their brand and becoming invisible – unless this is their chosen business model.

All of this will result in legislative and regulatory reform of the entire financial services industry. History demonstrates business models, technology and processes evolve first followed by legislation and regulation which play catch-up. Whilst the incumbents have a head start with respect to working in the very complex regulatory framework within which they abide by that will merely buy them some time. Incumbents should assess their existing business models and look in a new direction. They need to assess and identify the correct business model/s else risk finding themselves working within a business model that does not complement their strategy or even worse is not centred around the customer. The right business model will help enable more informed decisions around prioritising technology and digital transformation and ultimately their bottom line.

I have said it more than once – think less like a bank, and more like a technology organisation providing banking services and don’t limit yourself to what you already know. This will allow incumbent banks to become disruptors of other industries in their own right if they choose to do so and designing new value chains that enable them to hold onto the customer relationship. Now wouldn’t that be something!

Editor’s Note: Published with permission of the author with first publication on his blog – smarbl – a marble for our thoughts.